IRS mileage rate: What expenses are included

When it comes to business expenses, the IRS has a few rules and regulations that you need to be aware of. One such rule is the mileage rate, which is the amount you can deduct for business-related travel expenses. But what exactly does the mileage rate cover?

The mileage rate covers any expenses related to the use of your personal vehicle for business purposes. This includes things like gas, oil, repairs, tires, insurance, and depreciation. Basically, anything that has to do with the operation and maintenance of your vehicle can be included in the mileage rate.

Keep in mind that you can only deduct the business-related portion of your travel expenses. So, if you use your car for both business and personal purposes, you will need to keep track of the miles you drive for each.

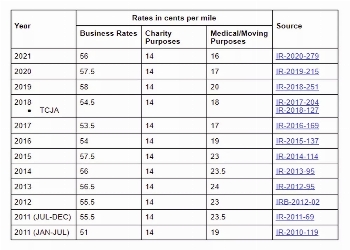

The IRS mileage rate for 2022 is 62.5 cents per mile. So, if you drove 1,000 miles for business purposes, you could deduct $625 from your taxes.

While the mileage rate is a great way to deduct your business-related travel expenses, it's important to keep good records. This means keeping track of the miles you drive, as well as any receipts for things like gas, oil, or repairs.

If you have any questions about the IRS mileage rate or how to deduct your business-related travel expenses, be sure to speak with a tax professional.

When it comes to calculating your taxes, the IRS offers a standard mileage rate that you can use to deduct the costs of driving for business purposes. But what exactly does this mileage rate cover? Here's a look at some of the expenses that are included in the IRS mileage rate.

Gasoline: Obviously, one of the biggest expenses associated with driving is gasoline. The IRS mileage rate includes the cost of gas, so you can deduct the amount you spend on gas when you're calculating your business mileage deduction.

Oil changes: In addition to the cost of gasoline, the IRS mileage rate also includes the cost of routine maintenance like oil changes. So if you get your oil changed while you're on a business trip, you can include that cost in your deduction.

Tires: Another routine maintenance expense that's included in the IRS mileage rate is the cost of new tires. If you have to buy new tires for your car while you're using it for business purposes, you can deduct the cost of the tires from your taxes.

Depreciation: The IRS mileage rate also includes a depreciation component, which allows you to deduct a portion of the cost of your vehicle over time. This is especially helpful if you're using a newer vehicle for business purposes, as you can deduct a portion of the cost of the vehicle each year.

These are just some of the expenses that are included in the IRS mileage rate. When you're calculating your business mileage deduction, be sure to keep track of all of your expenses so you can get the most accurate deduction possible.

-

02/02/2024 234

02/02/2024 234 -

11/17/2023 201

11/17/2023 201 -

11/16/2023 206

11/16/2023 206 -

11/16/2023 243

11/16/2023 243 -

11/16/2023 226

11/16/2023 226 -

11/07/2023 222

11/07/2023 222 -

11/06/2023 254

11/06/2023 254 -

07/10/2023 280

07/10/2023 280

-

12/08/2016 5652

12/08/2016 5652 -

03/22/2018 2679

03/22/2018 2679 -

10/10/2016 2636

10/10/2016 2636 -

01/09/2017 2528

01/09/2017 2528 -

01/13/2017 2177

01/13/2017 2177 -

01/13/2017 2166

01/13/2017 2166 -

01/14/2017 2004

01/14/2017 2004 -

11/06/2019 1990

11/06/2019 1990

FEATURED NEWS

Shopping Tips

Misc

Shopping Tips

Personal Finance

Shopping Tips

LEAVE A COMMENT